The Crocodile Will Soon Snap

Markets are flashing textbook warning signs. Divergences are stacking up, valuations are stretched, and the crocodile’s jaws are wide open. History says they won’t stay that way for long — and investors must choose a side.

Divergences.

In investing, that’s not a word you want to hear.

Why? Healthy markets confirm their trends. We want a bull market backed by broad participation and classic indicators: breadth (how many stocks are rising), momentum, and seasonal patterns. When price races ahead while those indicators stall, we don’t get confirmation; we get a divergence – a disconnect between price and the underlying engine that usually powers it.

That’s where we are in mid-August: red flags popping up across several well-watched gauges.

What usually happens in such a setup is best captured by the crocodile analogy: the market opens its jaws wide, just like the prehistoric predator.

And then, with high probability – or to put it in investor terms, with an unattractive risk/reward –, the gap between the upper and lower jaw has to close. That can happen in two ways:

But here’s the twist: in nature, crocodiles can only close their jaws from the top down. And in markets, when the gap is wide and risk/reward looks poor, history suggests the easier path is usually down, too.

And that’s why, given today’s market setup, the odds say just one thing.

The crocodile – a.k.a. the market – is about to snap.

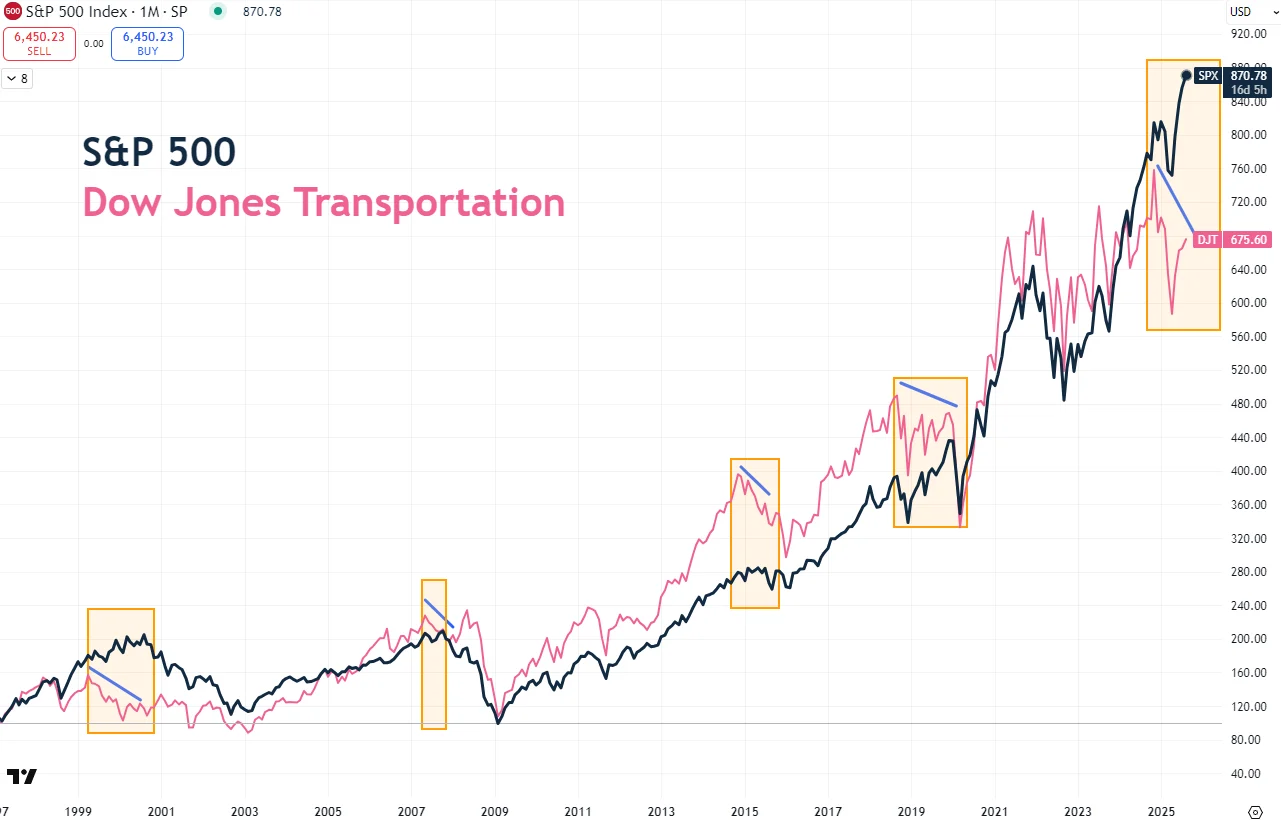

A great historic example of a hefty divergence is playing out right now – straight from the classic Dow Theory, a 100+ year-old framework used by market veterans to spot major trend shifts before they make headlines.

At its core, the Dow Theory says: for a market rally to be sustainable, both the broader market (Dow Jones Industrial Average or S&P 500) and the Dow Jones Transportation Index must move in the same direction.

And why transportation? Because it reflects the movement of goods – a direct proxy for real economic activity. No goods being shipped = no business being done = red flags.

Now, look at the chart:

Chart 1: S&P 500 and Dow Jones Transportation: Divergence