The market at an all-time high – invest or wait?

arvy's Teaser: The stock market is at an all-time high — and many investors feel uneasy. The fear of “buying at the top” is one of the most common reasons people stay on the sidelines.

But history tells a very different story. Data clearly shows that time in the market beats timing the market. In this article, we explain why all-time highs are not a reason to avoid investing — and why at arvy we consistently recommend Dollar Cost Averaging (DCA), also known as investing via a savings plan.

An all-time high does not signal danger — it signals long-term economic progress. Companies grow earnings, innovate, and increase productivity. Over time, stock prices reflect this growth.

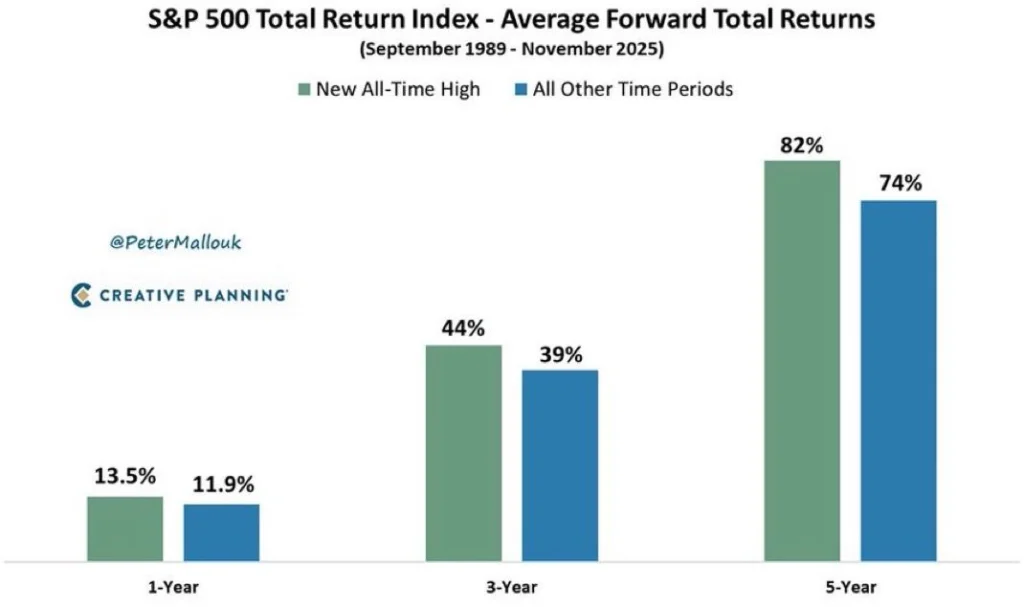

Historical data going back to 1989 shows:

👉 An all-time high does not mean markets are about to crash. In most cases, it means the long-term trend remains intact.

VMany investors try to wait for the “perfect” entry point.

Unfortunately, market timing rarely works — even for professionals.

Research consistently shows:

The key driver of long-term investment success is simple: How long your money stays invested — not when you invest it.

The longer you stay invested, the more powerful the compounding effect becomes.

Even with solid data, emotions are hard to ignore.

That’s where Dollar Cost Averaging (DCA) comes in.

With DCA, you don’t need to worry about market highs or lows. You follow a plan — and let discipline and time work in your favor.

At arvy, we don’t believe in market timing or short-term speculation.

Our investment philosophy is built on:

Not because it’s exciting — but because it’s proven to work.

✔️ All-time highs are not a reason to stay out of the market

✔️ Time in the market beats timing the market

✔️ Dollar Cost Averaging reduces risk, stress, and bad decisions

✔️ Long-term investing is consistently rewarded

👉 The best time to invest was yesterday. The second-best time is today.